If you've ever faced a deployment, you know one of the first things you'll be told to do for family readiness is to get a copy of your spouse's Leave and Earnings Statement (LES) -- and to make sense of it.

Even if a deployment isn't on your horizon, it's good to be familiar with the LES. We've heard horror stories about spouses learning their husbands turned down SGLI, and others for whom extra pay was (surprise!) deposited into their accounts by mistake and the family didn't realize until the military withdrew that overpay from the next paycheck.

Quite literally, it pays to know your way around an LES. Here's our line-by-line guide to making sense of one.

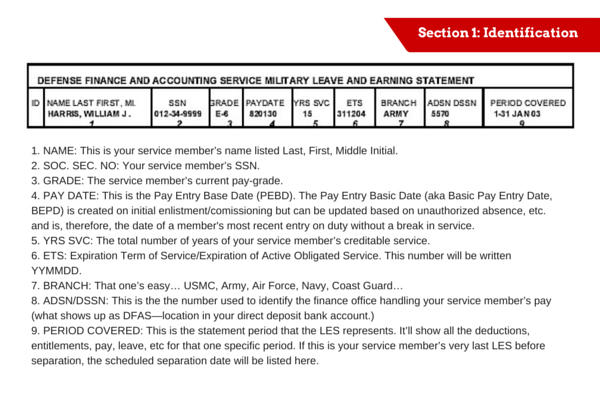

Fields 1-9 focus on identification.

1. NAME: This is the service member's name listed Last, First, Middle Initial.

2. SOC. SEC. NO: The service member's SSN.

3. GRADE: The service member's current paygrade.

4. PAY DATE: This is the Pay Entry Base Date (PEBD). The Pay Entry Basic Date (aka Basic Pay Entry Date, BEPD) is created on initial enlistment/commissioning but can be updated based on unauthorized absence, etc. and is, therefore, the date of a member's most recent entry on duty without a break in service.

5. YRS SVC: In two digits, the actual years of creditable service.

6. ETS: Expiration Term of Service/Expiration of Active Obligated Service. This number will be written YYMMDD.

7. BRANCH: That one's easy -- USMC, Army, Air Force, Navy, Coast Guard.

8. ADSN/DSSN: This is the the number used to identify the finance office handling the service member's pay (what shows up as DFAS -- location in your direct deposit bank account.)

9. PERIOD COVERED: This is the statement period that the LES represents. It'll show all the deductions, entitlements, pay, leave, etc. for that one specific period. If this is the service member's very last LES before separation, the scheduled separation date will be listed here.

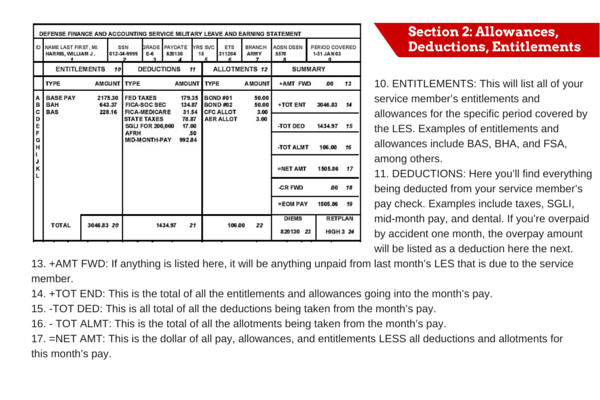

Fields 10-24 contain entitlements, deductions and retirement.

This is where you'll want to look for extra pay (if any), and all the things being withdrawn from pay (like taxes, Social Security, TSP, etc).

10. ENTITLEMENTS: This will list all of the service member's entitlements and allowances for the specific period covered by the LES. Examples of entitlements and allowances include BAS, BAH, and FSA, among others.

11. DEDUCTIONS: Here you'll find everything being deducted from the service member's pay check. Examples include taxes, SGLI, mid-month pay, and dental. If you're overpaid by accident one month, the overpay amount will be listed as a deduction here the next. (So if the pay ever looks low to you, check here first!)

12. ALLOTMENTS: Allotments are less common, but here you will see any allotments the service member has coordinated. For example, there may be specified discretionary allotments for savings accounts, rent or investments. There may also be non-discretionary allotments listed here, like any child support automatically deducted from pay.

13. +AMT FWD: If anything is listed here, it will be anything unpaid from last month's LES that is due to the service member.

14. +TOT ENT: This is the total of all the entitlements and allowances going into the month's pay.

15. -TOT DED: This is all total of all the deductions being taken from the month's pay.

16. - TOT ALMT: This is the total of all the allotments being taken from the month's pay.

17. =NET AMT: This is the dollar value of all pay, allowances and entitlements LESS all deductions and allotments for this month's pay.

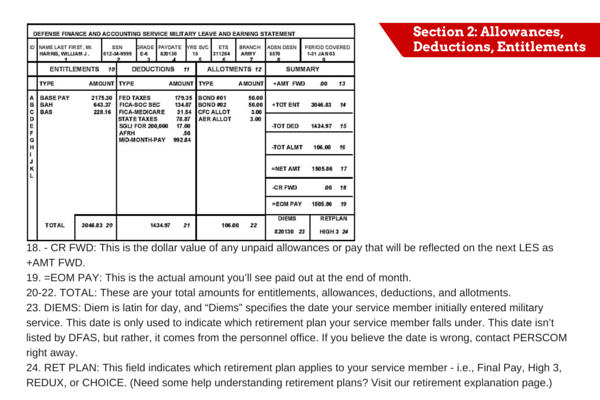

18. - CR FWD: This is the dollar value of any unpaid allowances or pay that will be reflected on the next LES as +AMT FWD.

19. =EOM PAY: This is the actual amount you'll see paid out at the end of month.

20-22. TOTAL: These are your total amounts for entitlements, allowances, deductions and allotments.

23. DIEMS: Date Initially Entered Military Service. This date is used only to indicate which retirement plan a service member falls under. This date isn't listed by DFAS, but rather, it comes from the personnel office. If you believe the date is wrong, contact them right away.

24. RET PLAN: This field indicates which retirement plan applies to the service member

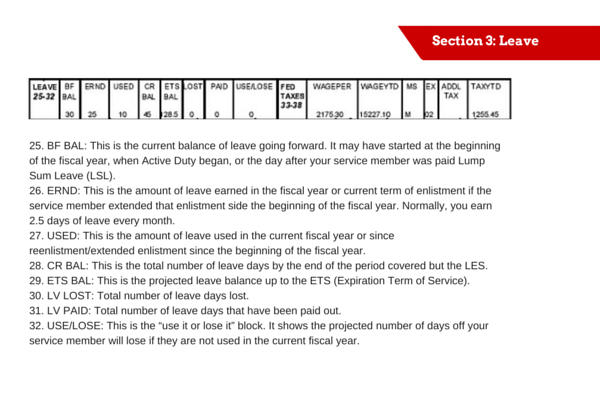

Fields 25 through 32 have leave information.

25. BF BAL: This is the current balance of leave going forward. It may have started at the beginning of the fiscal year, when active duty began, or the day after the service member was paid Lump Sum Leave (LSL).

26. ERND: This is the amount of leave earned in the fiscal year or current term of enlistment if the service member extended that enlistment side the beginning of the fiscal year. Normally, you earn 2.5 days of leave every month.

27. USED: This is the amount of leave used in the current fiscal year or since re-enlistment/extended enlistment since the beginning of the fiscal year.

28. CR BAL: This is the total number of leave days by the end of the period covered by the LES.

29. ETS BAL: This is the projected leave balance up to the ETS (Expiration Term of Service).

30. LV LOST: Total number of leave days lost.

31. LV PAID: Total number of leave days that have been paid out.

32. USE/LOSE: This is the "use it or lose it" block. It shows the projected number of days of leave that will be lost if not taken in the current fiscal year.

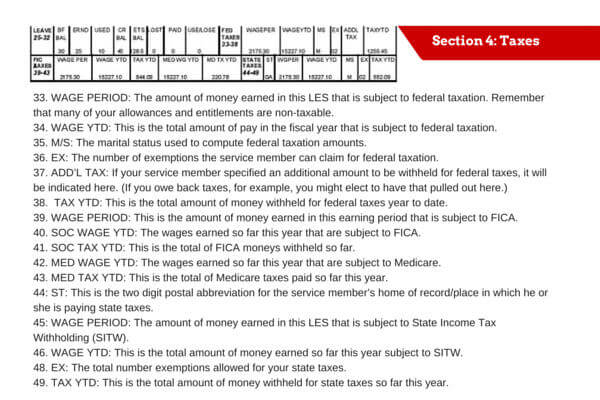

Fields 33 through 38 contain Federal Tax information.

33. WAGE PERIOD: The amount of money earned in this LES that is subject to federal taxation. Remember that many of your allowances and entitlements are non-taxable, so this number will not be the same as your total pay.

34. WAGE YTD: This is the total amount of pay in the fiscal year that is subject to federal taxation.

35. M/S: The marital status used to compute federal taxation amounts.

36. EX: The number of exemptions the service member can claim for federal taxation.

37. ADD'L TAX: If the service member specified an additional amount to be withheld for federal taxes, it will be indicated here. (If you owe back taxes, for example, you might elect to have that pulled out here.)

38. TAX YTD: This is the total amount of money withheld for federal taxes year to date.

Fields 39 through 43 deal with Federal Insurance Contributions Act (FICA) information.

39. WAGE PERIOD: This is the amount of money earned in this earning period that is subject to FICA.

40. SOC WAGE YTD: The wages earned so far this year that are subject to FICA.

41. SOC TAX YTD: This is the total of FICA moneys withheld so far.

42. MED WAGE YTD: The wages earned so far this year that are subject to Medicare.

43. MED TAX YTD: This is the total of Medicare taxes paid so far this year.

Fields 44 through 49 contain State Tax information.

44: ST: This is the two digit postal abbreviation for the service member's home of record/place in which they are paying state taxes.

45: WAGE PERIOD: The amount of money earned in this LES that is subject to State Income Tax Withholding (SITW).

46. WAGE YTD: This is the total amount of money earned so far this year subject to SITW.

48. EX: The total number exemptions allowed for your state taxes.

49. TAX YTD: This is the total amount of money withheld for state taxes so far this year.

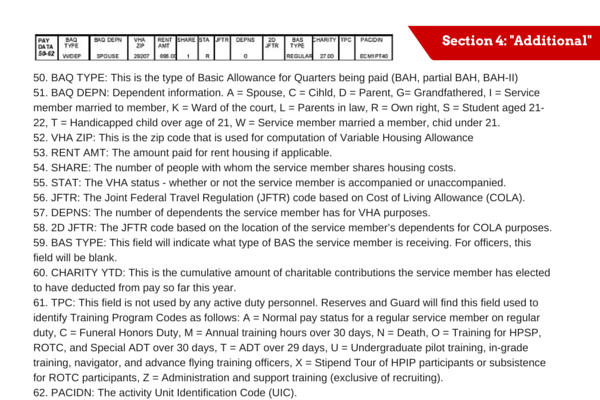

Fields 50 through 62 contain what is called "additional pay data."

50. BAQ TYPE: This is the type of Basic Allowance for Quarters being paid (BAH, partial BAH, BAH-II RC/T, etc.)

51. BAQ DEPN: Here is where dependent information is listed. A = Spouse, C = Child, D = Parent, G= Grandfathered, I = Service member married to member, K = Ward of the court, L = Parents in law, R = Own right, S = Student aged 21-22, T = Handicapped child over age of 21, W = Service member married a member, child under 21.

52. VHA ZIP: This is the ZIP code that is used for computation of Variable Housing Allowance, if that entitlement applies.

53. RENT AMT: The amount paid for rent housing if applicable.

54. SHARE: The number of people with whom the service member shares housing costs.

55. STAT: The VHA status -- that means whether or not the service member is accompanied or unaccompanied.

56. JFTR: The Joint Federal Travel Regulation (JFTR) code based on the location for the service member's Cost of Living Allowance (COLA).

57. DEPNS: The number of dependents the service member has for VHA purposes.

58. 2D JFTR: The JFTR code based on the location of the service member's dependents for COLA purposes.

59. BAS TYPE: This field will indicate what type of BAS the service member is receiving. For officers, this field will be blank. All others will see either B = Separate rations, C = TDY/PCS/Proceed Time, H = Rations-in-kind not available, K = Rations under emergency conditions.

60. CHARITY YTD: This is the cumulative amount of charitable contributions the service member has elected to have deducted from pay so far this year.

61. TPC: This field is not used by any active-duty personnel. Reserves and Guard will find this field used to identify Training Program Codes as follows: A = Normal pay status for a regular service member on regular duty; C = Funeral Honors Duty; M = Annual training hours over 30 days; N = Death; O = Training for HPSP, ROTC, and Special ADT over 30 days; T = ADT over 29 days; U = Undergraduate pilot training, in-grade training, navigator, and advance flying training officers; X = Stipend Tour of HPIP participants or subsistence for ROTC participants; Z = Administration and support training (exclusive of recruiting).

62. PACIDN: The activity Unit Identification Code (UIC), currently used by Army only.

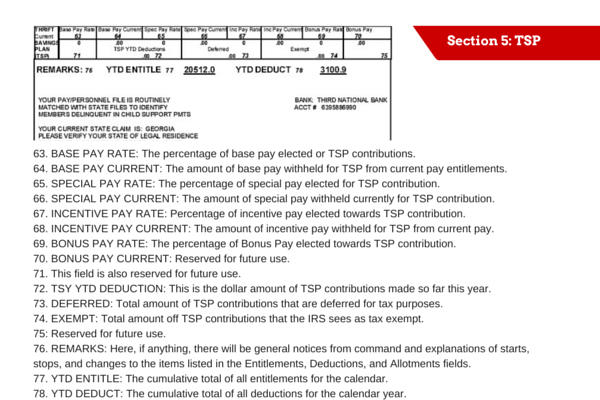

Fields 63 through 75 contain Thrift Savings Plan (TSP) information.

63. BASE PAY RATE: The percentage of base pay elected or TSP contributions.

64. BASE PAY CURRENT: Reserved for future use.

65. SPECIAL PAY RATE: The percentage of special pay elected for TSP contribution.

66. SPECIAL PAY CURRENT: Reserved for future use.

67. INCENTIVE PAY RATE: Percentage of incentive pay elected towards TSP contribution.

68. INCENTIVE PAY CURRENT: Reserved for future use.

69. BONUS PAY RATE: The percentage of Bonus Pay elected towards TSP contribution.

70. BONUS PAY CURRENT: Reserved for future use.

71. Reserved for future use.

72. TSP YTD DEDUCTION: This is the dollar amount of TSP contributions made so far this year.

73. DEFERRED: Total amount of TSP contributions that are deferred for tax purposes.

74. EXEMPT: Total amount off TSP contributions that the IRS sees as tax exempt.

75: Reserved for future use.

76. REMARKS: Here, if anything, there will be general notices from command and explanations of starts, stops and changes to the items listed in the Entitlements, Deductions and Allotments fields.

77. YTD ENTITLE: The cumulative total of all entitlements for the calendar.

78. YTD DEDUCT: The cumulative total of all deductions for the calendar year.

Whew! That's a lot to make sense of. Hopefully our one-stop explanation of the LES has helped you navigate your service member's LES.

Up to 30% off tuition for active duty and spouses

Southern New Hampshire University offers up to 30% off tuition for active duty military and their spouses. Request information.

Keep Up With Military Pay Updates

Military pay benefits are constantly changing. Make sure you're up-to-date with everything you've earned. Subscribe to Military.com to receive updates on all of your military pay and benefits, delivered directly to your inbox.